Andy is a broker from “AVA Brokers”. He needs to help his client, an asset management company “Beth Management”, to find suitable insurance for 100 office assets for an asset owner, “C&D Group”. C&D have a legal obligation to report their Scope 1, 2 and 3 carbon emissions as part of the incoming Task Force on Climate-Related Disclosures (TCFD) reporting requirement. The 100 assets managed by Beth’s are located in various locations across the UK, 15 of them are brand new, built under the latest RICS UK building standards; 15 have been recently retrofitted to improve their energy efficiency and heat/flood resilience. C&D wants to retrofit more, but struggle on what measures to implement and in which order.

Beth wants the 30 new or recently retrofitted assets to have improved insurance terms & conditions as they have more robust building components, which also show better energy efficiency, and the newly installed flood and heat wave resilience measures can largely reduce the physical risks of the assets. They also hope that Andy could help them figure out measures to improve the 70 other assets and the potential of retrofitting for better insurance coverage. However, some of these assets could be too expensive to retrofit and end up being “stranded”.

Witnessing the progress of climate change response in his company, Andy is interested in the impacts of the insurance industry to the transition to net zero and how ESG reporting affects businesses. Beth’s requests provided him an opportunity to explore the potential of rewarding better performance buildings through better insurance terms and conditions. He would like to find the right data to support his vision.

Apart from general building information and some risk data provided by C&D and Beth, Andy needs to collect missing data for creating a schedule of risks and a risk management report for Insurers, capture additional data elements that inform mitigation and improve resilience of these exposures to improve asset risk profiles that could bring improved terms and conditions, and gather relevant claims and premiums information to be at a better position to negotiate insurance rates for Beth. Furthermore, he needs to find additional data that can enable him to work with insurers to innovate new insurance products that can reward net-zero behaviours and help Beth to retrofit and decarbonise their old assets.

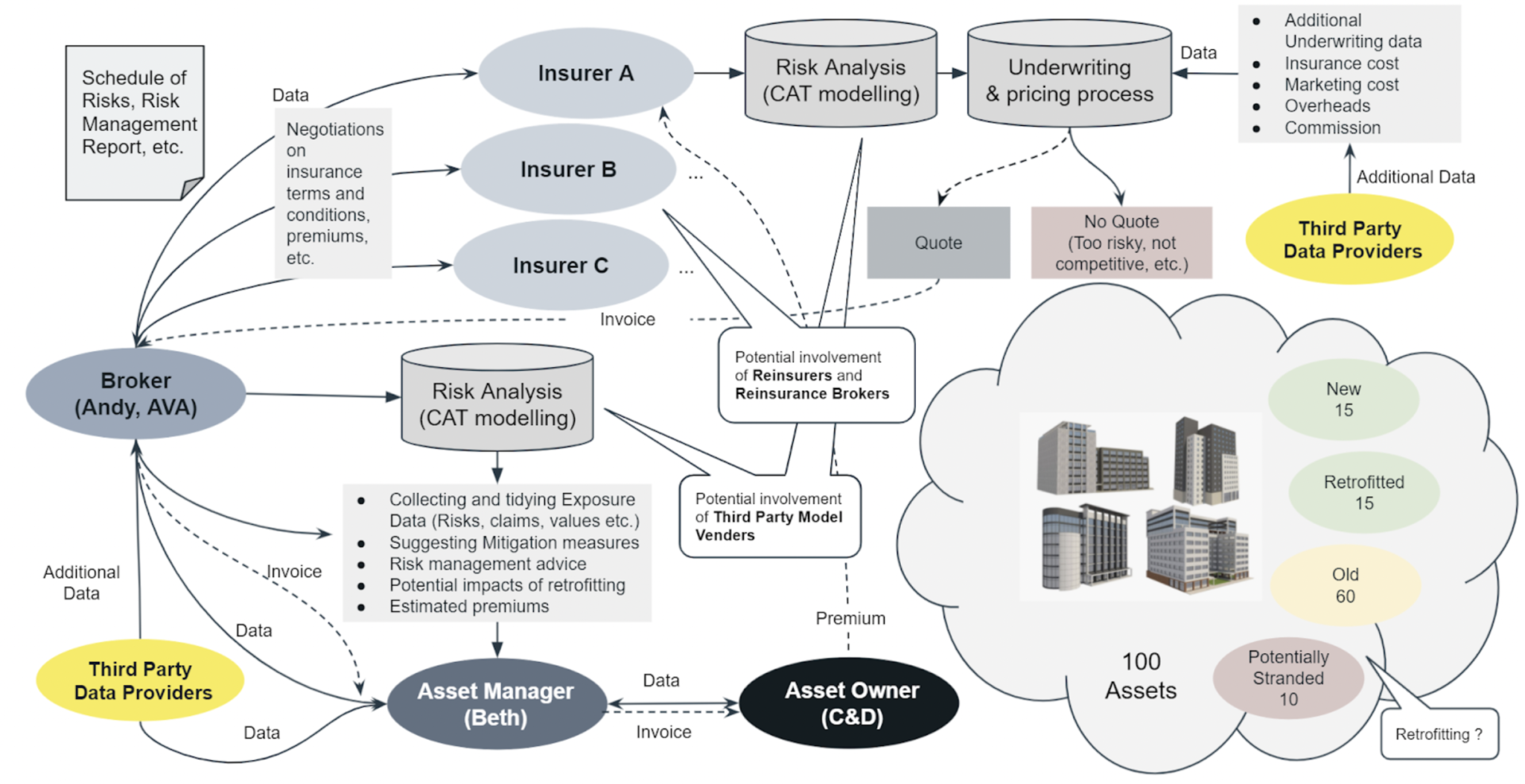

Figure 2 maps the ecosystem in the insurance market and illustrates the current process for this use case to happen. The major data inflow points are at broker Andy and the insurers he connects with. The essential information in the process are the data for catastrophe modelling and insurance pricing, including primary modifiers (e.g. age, location, construction, number of stories and occupancy), secondary modifiers (e.g. roof geometry and anchorage, construction quality, cladding, and basement etc.) for major catastrophe risks, and also building value and claims history, etc.

Other data such as risk management and mitigation are useful for negotiating a better policy. All stakeholders play a role in data sharing, either as a data owner/provider or data user in this ecosystem. Large broking companies and insurers may have their own catastrophe modelling team and underwriting team to perform analytics for clients/customers. For smaller broking and insurance companies, they may rely on third party model vendors to carry out risk analysis, underwriting and pricing processes. At each data point in the ecosystem, there may be various issues causing the data recipients to look for alternative solutions from third party data providers, to fill data gaps and overcome data quality issues.

At the end of the data chain, the insurer’s underwriting and pricing process may conclude some old assets are not insurable due to high risks or not profitable reasons. For those assets, Andy then needs to work with Beth and C&D to work out retrofitting solutions to make them insurable or consider other options. There are opportunities to work with insurers to explore new innovative insurance products that consider a retrofitting roadmap for these buildings and assist Beth and C&D to retrofit and improve resilience.

Data Required for the Use Case

There are a number of important datasets to enable this use case to be realised. Table 1 lists the data required to deliver this use case.

| Data Items | Data Providers | Data Users | Data Purpose | Current Access | Potential Data Issues |

| Financial Data (e.g. Building values, Content values to cover, Business revenue etc.) | Asset Owner / Manager | Broker | Useful for insurance pricing. | Bilateral Broking Contracts | Missing data, errors, out of date, etc. |

| General Building Information (inc. Location, Address, Function, Stories, Height, Roof, Building materials and products, basements, etc.) | Asset Owner / Manager | Broker | Specific information can be used for catastrophe modelling and insurance pricing. Specific detailed data can be potentially useful for improving risk analysis and pricing accuracy. | Bilateral Broking Contracts | Missing data, low quality, errors, out of date, wrong format etc. |

| Claims History | Asset Owner / Manager, Insurer | Broker | Useful for insurance pricing. | Bilateral Broking Contracts | Not available, missing or not shared |

| Building operational data (periodical or real-time data inc. Energy consumption, Water use, building maintenance, fire events, crime records, etc.) | Asset Owner / Manager | Broker | Currently is not included in the insurance underwriting process. Specific data such as real-time flood IoT data are used for parametric flood insurance. These data can reflect building management performance. Better management reduces building risks, therefore can be part of measures to determine insurance terms and conditions.) | Bilateral Broking Contracts | Not available, low quality, errors etc. |

| Schedule of risks (for a set of buildings, extracted from the building information and claims history provided by the Asset manager through data cleansing and analysis) | Broker | Insurer | Essential for catastrophe modelling (primary and 2nd modifiers) and insurance pricing | Bilateral Broking Service Agreement | Missing data, simple data, low quality due to data access issues etc |

| Assets risk management report (e.g. what measures taken to mitigate/reduce the risks, e.g. electricity, fire, flood etc) | Broker | Insurer | Useful for insurance pricing, insurer may request it | Bilateral Broking Service Agreement | Wrong format, not sufficient, not easy to use |

| Wide range of data covering catastrophe modelling data, Pricing data and Physical data, Historical and real-time data, Graphical and numerical data, geographical and individual data etc. that are missing through the connection between the asset manager and the broker. | Third Party Data providers (e.g Ordnance Survey, Data companies e.g. Earth Observation, Engineering, Survey, InsurTech, Energy services etc.) | Broker, Insurer, Third Party Model Vendors, Asset Manager | For catastrophe modeling, Underwriting and Pricing process when the asset manager fails to provide data | Bilateral Contracts (Majority), Preemptive license (very few), Open data license (A few) | Data invisible/ unsearchable, lack of data standards, data not usable, complex and tedious bilateral contracts, etc. |

| Risk Analysis Model Outputs | Third Party Model Vendors | Broker, Insurer | For Underwriting and Pricing, and filling data gaps | Bilateral license | Estimation, Artificial output |

| Sustainability Data (e.g. energy efficiency, energy consumption, water usage, waste management, embedded carbon, emission, etc.) | Asset Manager, Third Party Data Providers (e.g. Government or Non-profit open data sites, Energy providers, ESG service providers etc.) | Broker, Insurer | Currently not used in the insurance industry. Potentially can be used for net-zero underwriting and rewarding good performance | Open Data licenses, Preemptive licenses, Bilateral contracts | Low awareness, hard to find, not easy to use, lack of standards, low quality etc. |

Service and Shared Data Infrastructure Required to Deliver the Use Case

In the use case, major data exchange happens between the broker and the asset manager. However, in most cases the asset manager is not capable of fulfilling the broker’s data request due to various reasons, such as large numbers of complex assets, no data or missing data, errors, data too simple, quality too low, wrong format, not usable etc. To fill the data gaps, the broker has to approach a wide range of third party data providers, such as

- Ordnance Survey for locations, occupancy, adjacent risks, digital elevation model (DEM), building heights data etc.;

- Data Police UK for crimes data;

- Fire Service UK for fire stats;

- Flood data service for flood risk data;

- Catastrophe model vendor for wind risk data;

- EPC register for floor area and EPC rating.

Data is fragmented, scattered, unsearchable, incomplete, many of them have to go through bilateral contracts to access, some are simply not accessible. Sustainable data is even more difficult to find and figure out how to use them. It is very challenging and time consuming to gather required data to deliver the use case. A new data service is needed to address the challenge.

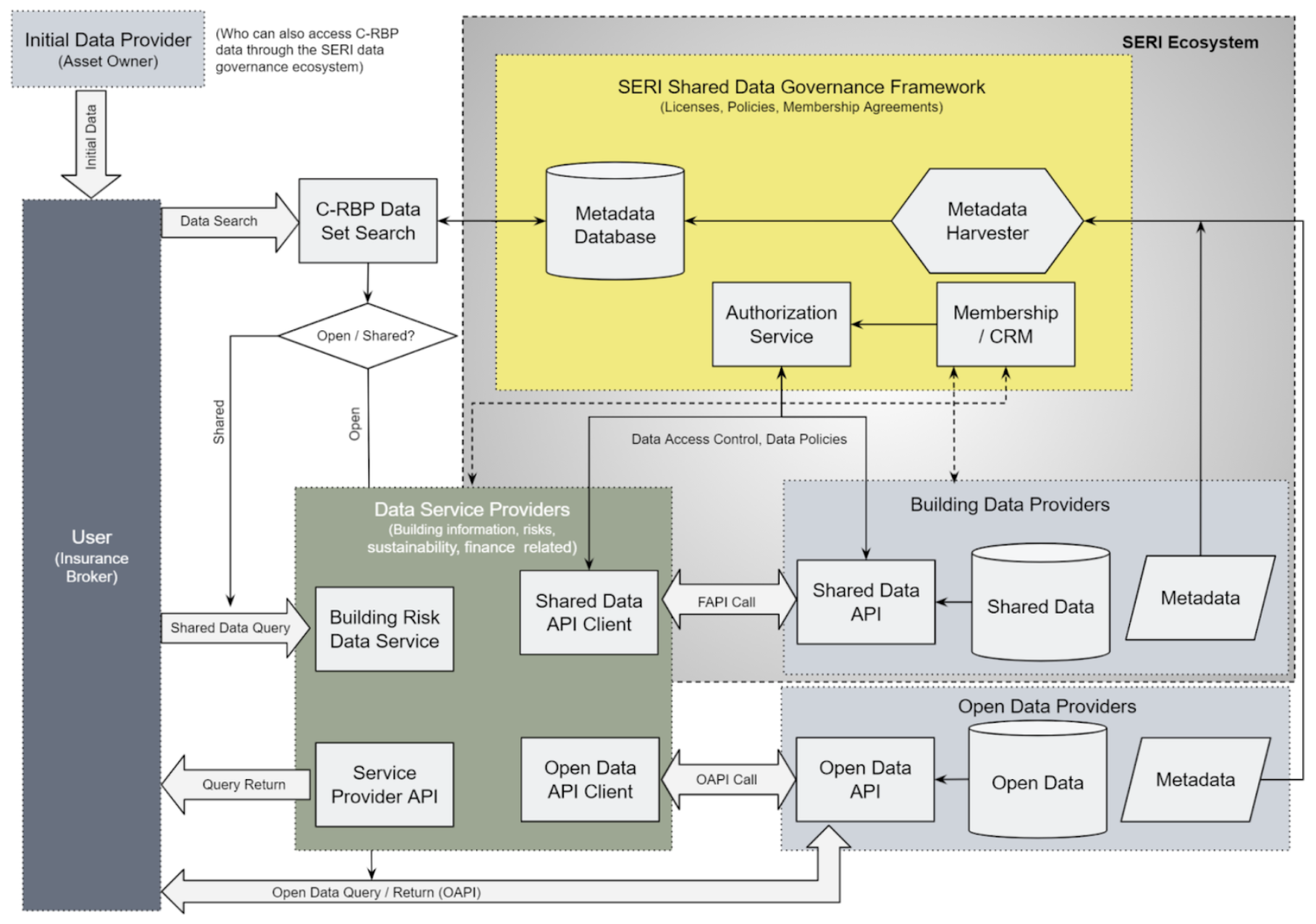

The new service is expected to be able to bring all the above fragmented data sources together either directly or through third party data service providers into a shared data governance framework, a secured digital infrastructure that promotes data sharing and consumption. The C-RBP supported by the SERI governance framework is the answer for it. The C-RBP will:

- Bring building data providers and data service providers on board the SERI shared data governance platform through membership consents

- Obtain public open datasets metadata for the SERI platform to enable both open and Shared Data can be visible to data users

- Promote digitalisation of building related data

- Enable access to both Open Data and Shared Data and serve Shared Data through preemptive licenses

- Provide data through member data providers and member data service providers whilst all data are still owned, kept and updated by the data providers

The SERI shared data governance framework is based on a secured data governance structure, i.e. the SERI Shared Data Governance Framework, built on Open Banking and Open Energy foundations and many open data sharing standards (e.g. preemptive licenses). Within this infrastructure, the collaboration with a wide range of stakeholders makes data discovery, aggregation, management, and sharing through federalised data services much easier and more efficient. Data governance within the infrastructure can provide a secure platform for many current Closed Data to be shared through preemptive licenses. It can unlock a lot of new data (e.g. financial, business and environmental data, especially mitigation data for climate change) for businesses to innovate and potentially incentivise net-zero behaviours.

Through the C-RBP service, Andy can easily discover various building information and building risk data (inc. both resilience and mitigation risks) from his computer. Once data is identified, the system will show him if he is eligible and how to access the data through the SERI standard and preemptive licenses. Figure 3 maps the major components of the SERI Shared Data Infrastructure and demonstrates how Andy can access different types of data (Open or Shared) through the C-RBP service.

With this service, all data he needs will be listed in the C-RBP Datasets Search (both Open and Shared Data), he can access Shared Data through preemptive licences. Andy no longer has to ask around to find data and data providers, then go through many bilateral contracts. The datasets from C-RBP are all digital and machine readable, and are produced under good data standards, easy to use and convert. This saves time, effort and money for him. The C-RBP also enables new datasets to be discovered. New and better datasets (e.g. operational data, emission data) can potentially give him insights to innovate.

Call for Support

The C-RBP is currently a concept designed by the SERI project. To enable the creation of the C-RBP service, we need support from data providers and data service providers from both the built environment sector and the insurance sector to be part of the SERI shared data governance framework. We also need support from wider stakeholders in the insurance and built environment value chains for consultation to understand more on the values C-RBP can bring and how they can be maximized for industries.

Photo credit: Photo by Dimitry Anikin on Unsplash