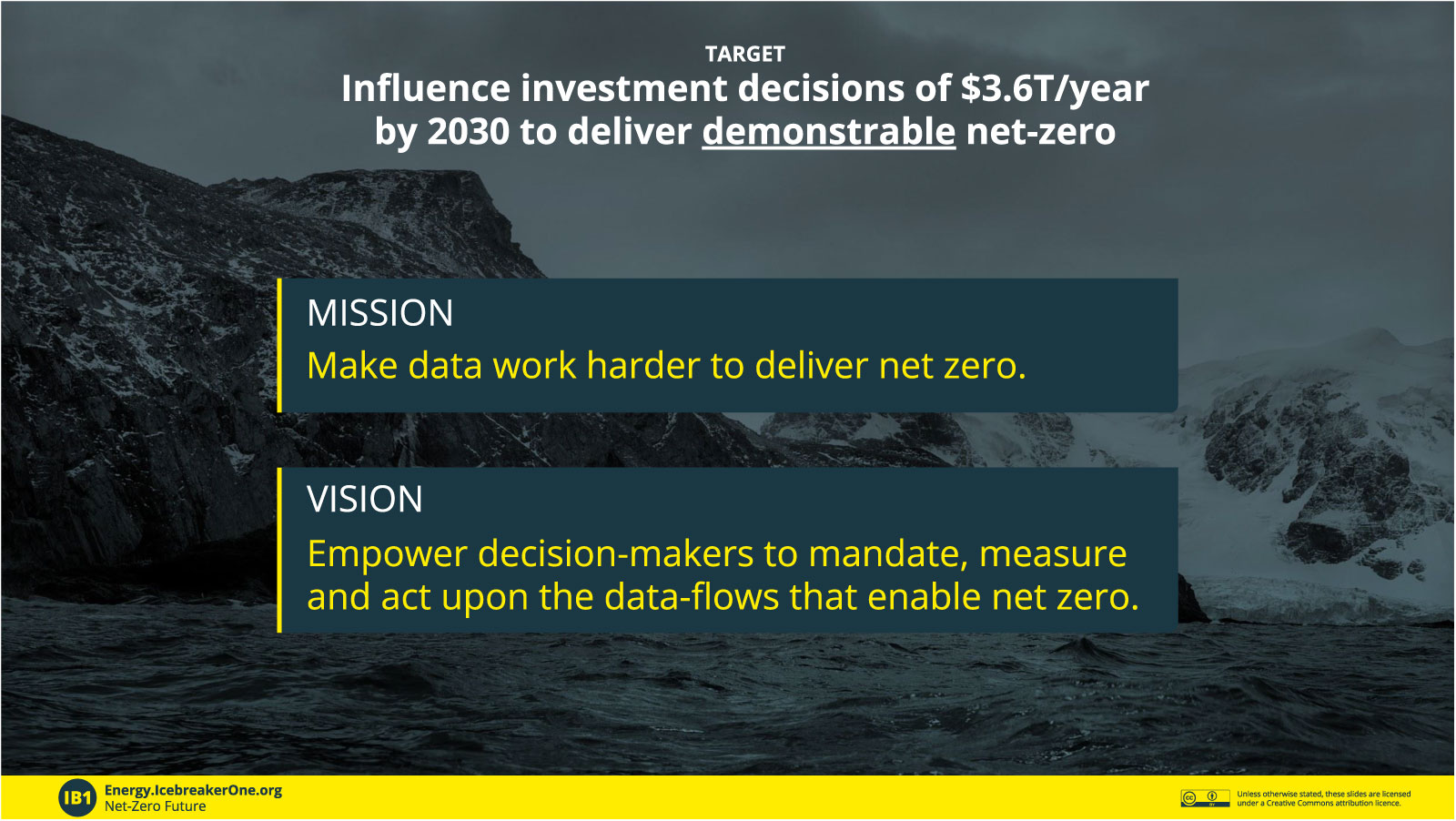

Mission: make data work harder to deliver our Net Zero Future

For more insight, click for a full-screen slide presentation

Icebreaker One unlocks assurable data discovery, access and usage through robust, collaborative data governance:

1. Icebreaking: continuous design of the rules of the game

2. Trust Frameworks: continuous implementation of those rules to support markets

Introduction

We are creating a web of net-zero data – connecting assurable financial, industry and environmental data to help inform net-zero decisions. As much of this data is restricted, we are enabling that web by creating policies and guardrails that ensure data is comparable, machine-readable and trusted. We connect rather than collect data, with a focus on culture, collaboration and data governance.

Outcomes include Open Standards and Trust Framework(s):

- A clear, trusted, impactful and detailed governance framework that enables government, businesses across sectors, consumers and third-party developers to understand the potential of open access to data.

- Detailed descriptions of the application of the framework in practice, based on user needs and use cases.

- Delivery of Search and Governance as industry-facing operational services that instil trust.

Icebreaker Principles

To achieve this we are working across the private and public sectors through:

- Icebreaking

Icebreaking is our process to understand user needs, map data value chains, develop processes and policies that unlock data flow, identify net-zero data standards & solutions, and begin to unlock & connect data. It includes formal processes through which stakeholders can convene to agree on needs, principles and codes of practice (through Steering, Advisory and Working groups). This is a continuous process that feeds into the Trust Framework, enabling the continuous improvement of solutions. - Trust Framework

The IB1 Trust Framework codifies processes and policies that govern data sharing (including both Open and Shared data). It enables authenticated, trusted data publishing & secure data usage with financial-grade access control to unlock net-zero data flow.

Our approach is aligned with, and has contributed to, nationally-developed ‘Trust, Prepare and Share‘ data strategies. The Icebreaker One Trust Framework codifies and operationalises (makes usable) rules to make data flow more easily between organisations. These principles & rules are co-designed via Icebreaking.

Through Icebreaking, we create multi-disciplinary, multi-sector collaborations with practical outcomes. We enable sectors to create net-zero data strategies and open standards. Further, we deploy tools that support net-zero data search and access control to accelerate action.

Why is this important?

According to the UN, “sector-specific data from companies in the real economy remains insufficient, unreliable, incomparable, or non-existent. As a result, investors are not able to fully steer investment portfolios in line with sector decarbonisation pathways or to set science-based targets at the sector level.”. This is the tip of the data iceberg.

Who are we?

Icebreaker One is an independent, non-partisan non-profit with global reach. It aims to influence investment decisions of $3.6T/year to deliver demonstrable net-zero by 2030. By unlocking the data infrastructure needed to share environmental & financial data it convenes organisations to understand how best to use data as a continuous flow of evidence that informs action. It is helping to instrument net-zero by connecting policy, strategy, risk management and investment to real-world data to enable climate-ready financial instruments, climate-aware risk management and climate-credible deployment of robust, long-term solutions

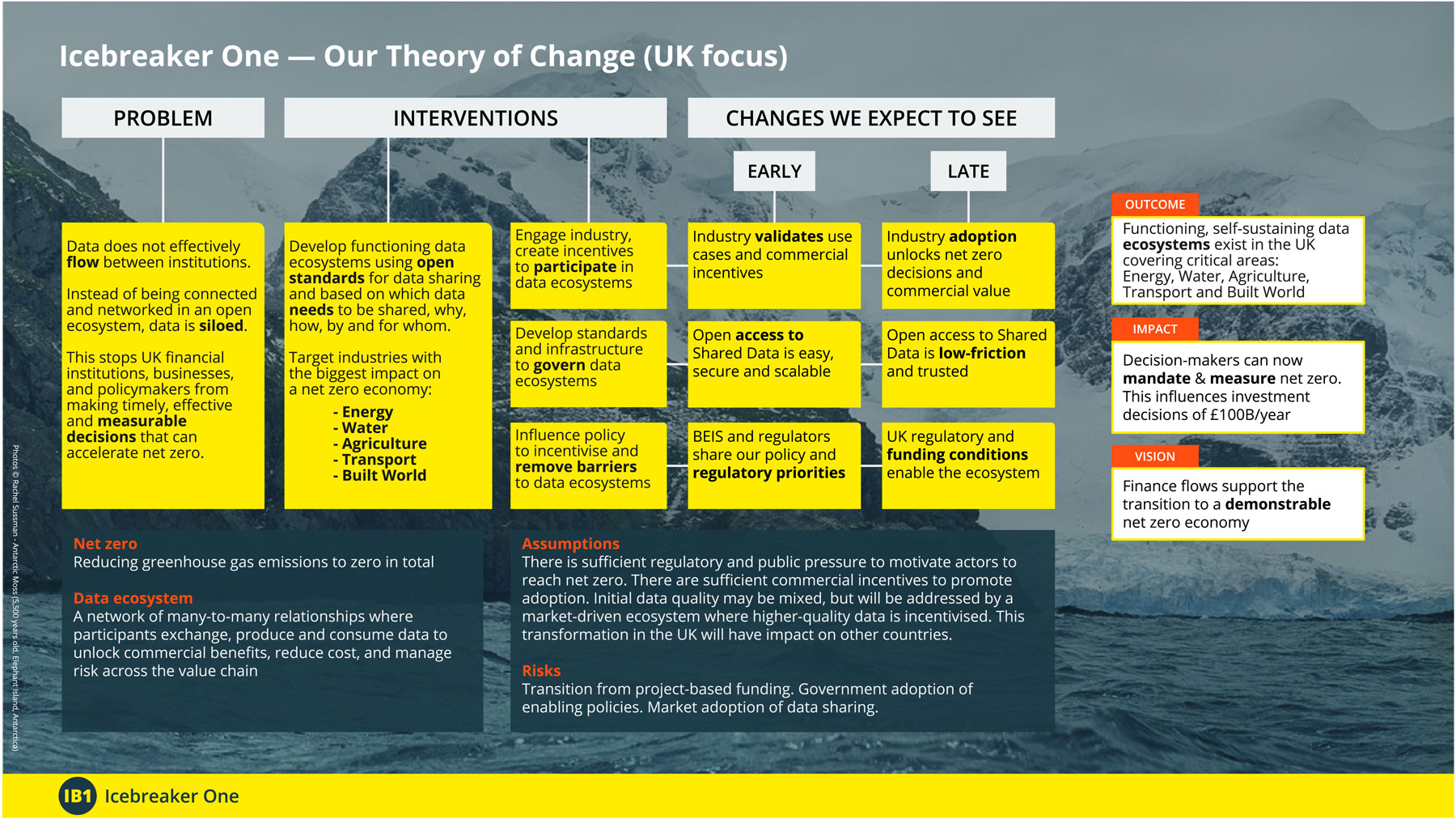

Our Theory of Change

We have developed a Theory of Change (UK-focus in the image above) to illustrate how we are developing our work.

Our central hypotheses include:

- Improving access to data helps businesses and the public sector innovate.

- Working with industry and government to develop Open Standards will unlock open access to shared data.

- Improved access to data is essential to country-level transitions and to deliver a green industrial revolution.

- This is a proven blueprint: with Treasury backing, Open Banking opened up secure access to shared financial data. It has since transformed the fintech sector, creating tens of billions of pounds in value.

- The public sector and regulators can work together with industry to deliver the funding, regulatory change, and convening needed to improve access to data.

The strategy is delivery*

We deliver this through Icebreaking and the Icebreaker One Trust Framework.

(click the three dots to select full screen)

The Icebreaker Constellation

Our work spans sectors that need to share net-zero data, including Finance, ESG, Energy, Built World, Transport, Agriculture and Water. The nature of these challenges is that there is no single place where all the data is, so we work with public and private sector organisations as a constellation of active participants, catalysing development through targetted initiatives using user needs to inform solutions that address our mission.

For example, Open Energy is a public-private initiative modernising data sharing across the entire energy grid to deliver a net-zero, decentralised energy future. Project Cygnus explored how COVID economic recovery can be directed to drive net-zero behaviours at city and regional levels across Europe. SERI is helping the insurance sector be a lever of change by developing Climate-Ready products: ensuring that net-zero solutions are protected and incentivised (e.g. some insurers won’t insure EV) as well as driving change so net-destructive industries are no longer financially viable.

If you would like to work with us, please get in touch: partners@icebreakerone.org.

Benefits & outcomes

- Address the business models, legal and policy of data sharing

(e.g. rights, licensing, security, liability, regulation) - Improve the provision, reliability and trust of data publishing and usage

- Develop & share the required expertise and change in knowledge, practice and culture

- Develop policy frameworks that address climate-specific interventions across the financial ecosystem

- Unlock the data ecosystem across global sensors, satellites, internet of things (IoT), geospatial, asset registries, risk reporting, trading schemes and financial instruments

- Enable data discovery (e.g. data search) at web-scale: lay the foundations for the web of net-zero data

Outputs & activities — how do we help instrument net-zero

We convene multi-disciplinary experts, teams and organisations across the public, private and scientific communities to develop:

- Open standards

Frameworks for robust and secure data sharing across environmental & financial data: principles and practice, Code(s) of Practice, voluntary standards, regulated Standards. - Solutions for trusted net-zero data sharing

Open services for net-zero data discovery, access and usage: OpenNetZero.org and Trust Frameworks. - Research and evidence

Use cases, reports, business models, economic modelling, policies and guidance. - Communication

Reporting on the evidence of innovation and the impact of activities. In public, trade and expert forums. - Events

Connecting expertise across siloes - Collaborative practices

Working groups (large and small; in-person and online)

* with thanks to GDS