This blog is the start of a mini-series that we have written as part of the SERI programme. Since starting our work in April, we’ve been researching, thinking and starting the product innovation process that will allow us to develop and test a climate-ready financial product by June 2021.

We’re always looking for people to join us on SERI and to help improve our thinking. To share your thoughts or to get involved in this programme please contact us.

Insurance is a complex industry. In simple terms, paying small amounts, or premiums, over time to an insurer entitles us to claim large sums from the insurer if things go wrong. However, insurance business models depend on complex interactions of industry, data, mathematical modelling, investment structures, commercial and non-commercial stakeholders, and of course, changing circumstances caused by events around us.

Data is a key part of insurance, but the data flows and channels that exist are closed and/or high-friction. Data sharing is often carried out through expensive, bilateral agreements. Furthermore, there is a lack of standard formats across the insurance landscape for data sharing, and data quality widely differs depending on its uses.

As part of SERI, we mapped out the insurance industry landscape to clarify the various segments, how they interact, and the data channels that exist between market participants. By understanding the value chains, data layers and “gatekeepers” of the insurance ecosystem, we aim to identify levers that can facilitate decarbonisation across the industry through shared data. Creating a standard for a robust data-sharing infrastructure can facilitate cross-industry inoperability to reach our net-zero targets.

This is the first iteration of the insurance landscape based on findings to date. You can explore it in detail here. If you have any comments or feedback or would like to collaborate to take this work further, please get in touch.

Mapping the insurance landscape part 1

Here, we look at numbered sections 1, 2 and 3 of the insurance landscape.

1. Insurance types and structures

Insurance is broadly split into life and non-life company types, primarily structured such as mutuals or stock / proprietary companies. Other hybrid structures of insurance exist, such as Lloyd’s syndicates, P&I clubs and takaful insurance. Parametric or index insurance is yet another type of insurance and differs from traditional insurance in how the payout is structured.

Life insurance is similar to investment savings and pensions in that there is always a lump sum payment at some point in time. Non-life insurance provides coverage for risks that may cause significant financial loss such as in the event of flooding, fire or a motor accident. Insurance for specific risk themes is known as insurance products. For example, a goods company may purchase a marine insurance product to protect its cargo at sea. Policies are specific insurance agreements between a customer and insurer based on that customer’s needs.

The customer buys an insurance policy to off-load a potential expensive financial loss onto the insurer. The insured policyholder thus transfers an unknown financial loss amount to the insurer for a defined price. This is known as risk transfer and is an element of risk management.

Furthermore, insurance companies can purchase reinsurance. Reinsurance companies take on financial risks that may be too large for the primary insurance company to bear for a predefined price. Here, the primary insurance company is the insured, or policyholder and the reinsurance company is the insurer. Reinsurance firms can thus further off-load risk by buying their own reinsurance, which is known as retrocession.

2. Insurance pricing

Insurance premiums and compensation limits are estimated through the pricing of risk. Risk pricing is derived mathematically from the probability of said risk, namely:

- the likelihood of its occurrence (will it happen?);

- the frequency (how often does it happen?); and

- the severity (how bad is it?).

The above are estimated through a variety of macro and microdata inputs. Different types of data (such as historic, financial, and geographic data to name a few) are used for the pricing of risk, and thus to estimate general premium amounts and compensation amounts for a particular theme or insurance product. Actuaries in the back office estimate the general product pricing range, while the underwriter uses individual factors to accurately price the individual’s policy. This exchange of information or data between the underwriter and the back office is a crucial part of the insurance business model. The underwriter has the final say on what risks the insurance company is willing to insure for the individual and at what cost

3. The insurance business

Levels of risk and their associated premiums from numerous insurance policies diversified across customers, products and geographies are held in the insurance companies’ portfolios. The premiums paid by customers make up the portfolio, which is invested to grow. The portfolio monitoring teams ensure appropriate levels of liquidity with respect to risk and associated payouts are maintained. In the event that a policyholder experiences a loss, for example, due to extreme weather events that cause flooding damage, the insurer pays out the claims from its portfolio (or book) once the claim is verified.

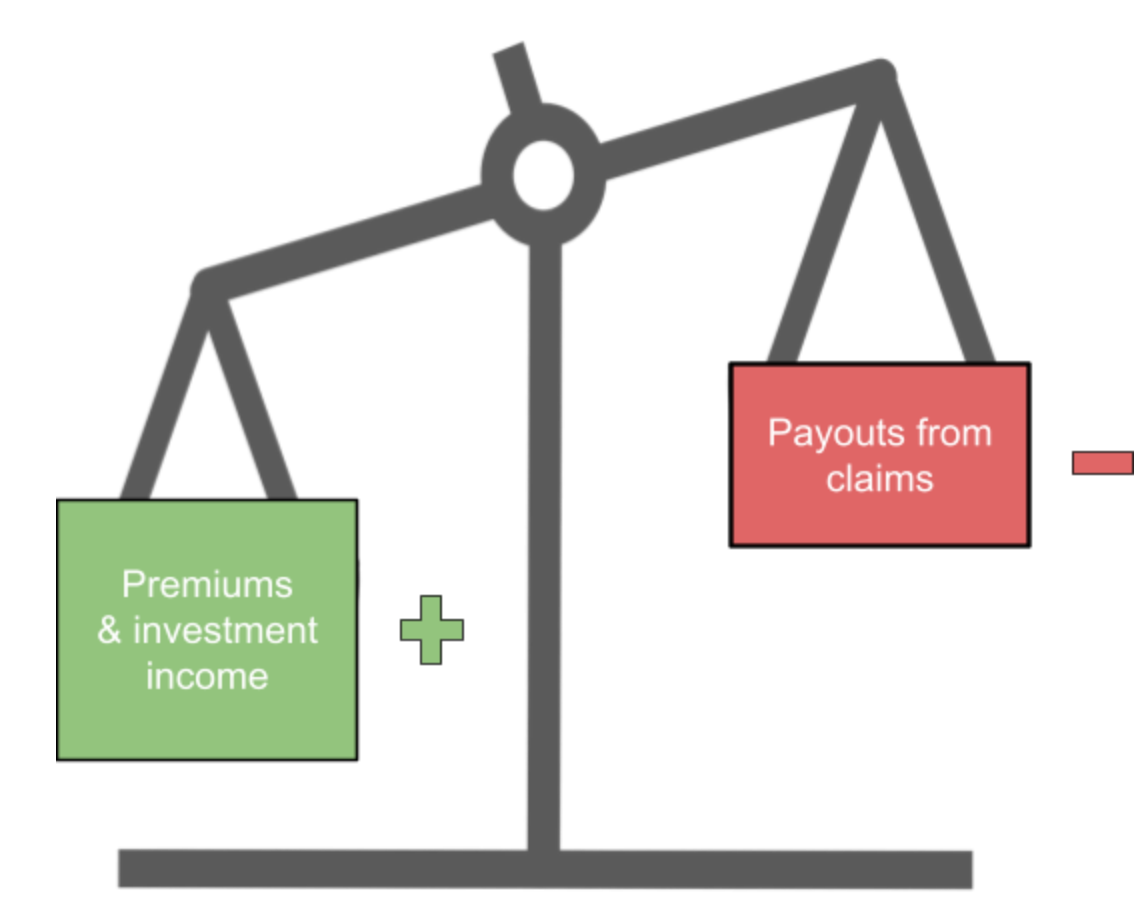

Insurance business models are based on carefully balancing the levels of risks due to few loss events (and therefore the associated claims payout) with the premiums paid by all policyholders. Insurance companies make money managing the portfolio to get more from the premiums than the companies have to pay out to service claims from their policyholders.

Insurance profits are thus made up of money made “balancing the book” (underwriting profits) and profits from investing premiums in the financial markets, which is discussed in part 2.