How data can make the transition to net zero a reality

On Wednesday, June 29th, Icebreaker One and Climate Arc held a London Climate Action Week event in collaboration with Chatham House, focussed on the role of open data and open standards for net-zero financial decisions and in the climate transition. With over 60 experts and practitioners in the financial, investment, and data analytics sectors, attendees helped identify key gaps and innovative solutions to bring climate science into mainstream investment decisions.

Register your interest to be involved

in future events and conversations

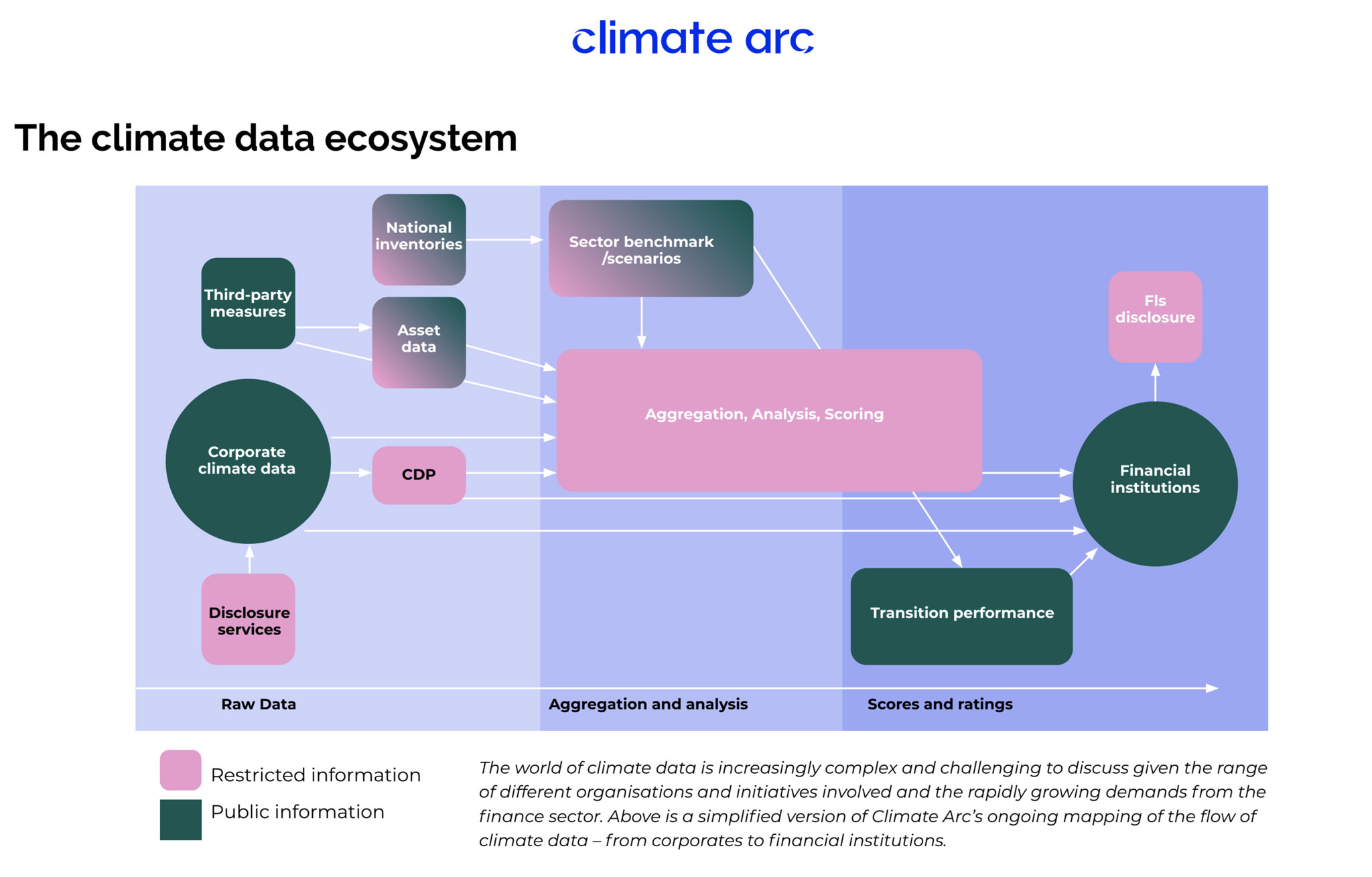

The world of climate data is increasingly complex and challenging to discuss given the range of different organisations and initiatives involved and the rapidly growing demands from the finance sector. Above is a simplified version of Climate Arc’s ongoing mapping of the flow of climate data – from corporates to financial institutions.

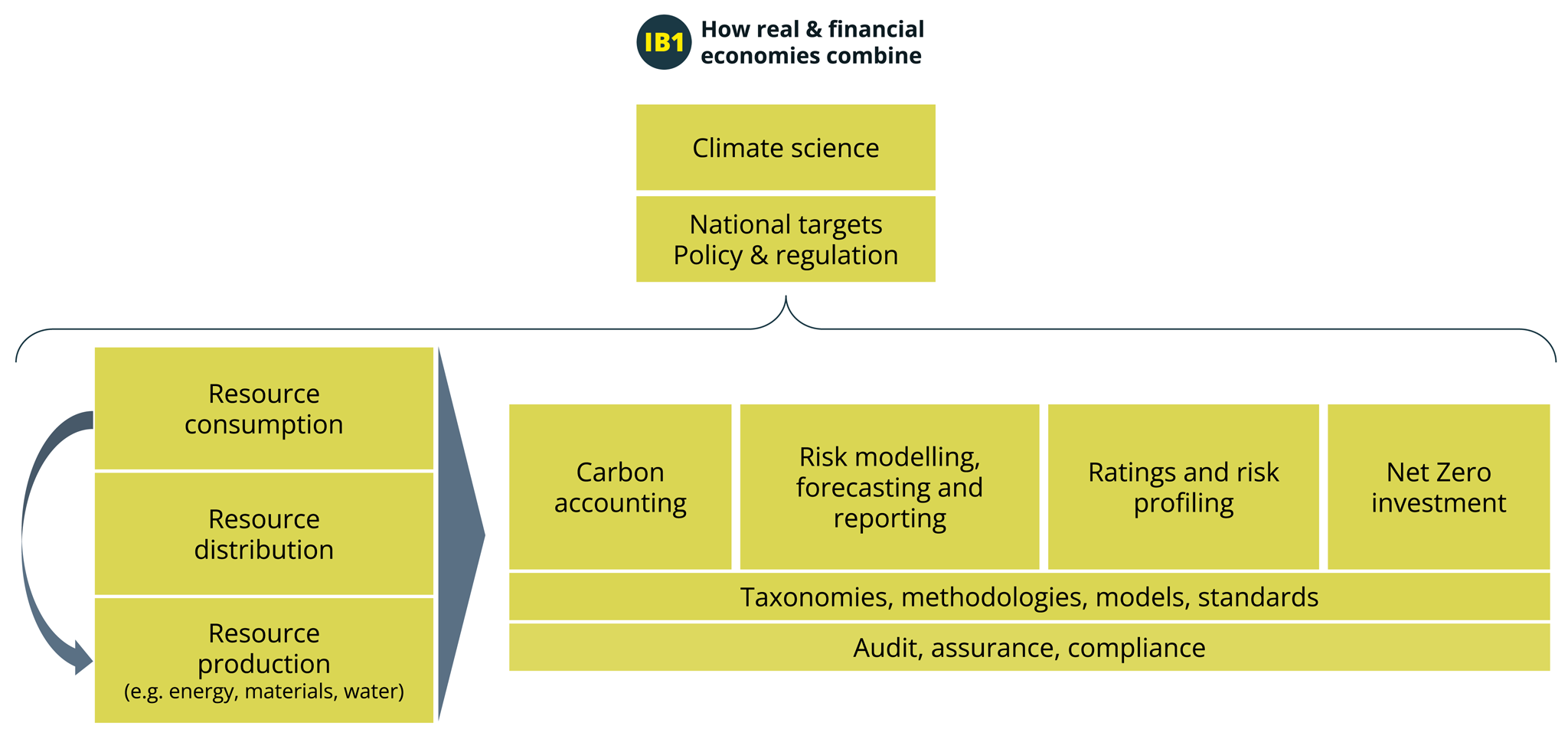

A broader view of the ecosystem, including real and financial data economy data, and models, is below:

The key themes and actions that emerged were:

Finance needs better access to net-zero data

- An open data and open standards approach would enable a clear ‘demand signal’ to be sent from the financial sector back to corporates, connecting net-zero financial decisions to the real economy. Users of climate data should be able to ‘see’ where climate data comes from and what methodological steps and estimates have been applied.

- This would require a set of rules and processes so that climate data is transparent, machine-readable and trusted. It could be achieved, for example, via a new Open Climate Data Standard. A federated, web-based approach could allow stakeholders to ‘connect’ rather than ‘collect’ – accelerating action.

- Whilst broad consensus exists over the need for open climate data, the different models and language for frameworks, disclosures, taxonomies and licensing (e.g. open license vs open access) are leading to some confusion among stakeholders.

Engagement is key to shaping an open climate finance data ecosystem

- There must be engagement with stakeholders on the ground and those actually dealing with a challenge and may know what data is needed.

- This should be a wide-reaching, actionable conversation, with global stakeholders.

- There is a well-defined challenge in gathering data from emerging markets where data is lacking. Individuals, organisations and representatives from emerging markets should be directly involved in this process.

The data needs to be consistent, transparent, and credible

- The data needs to be consistent, with clear standards which are transparent and credible.

- The data will need to be auditable, verifiable information to be usable in financial decision-making.

- There could be a common platform for modelling and sharing estimation methodologies to promote consistency in analysis, once the data infrastructure is in place.

- Increased transparency is needed on estimate methodologies to have accurate financial disclosure analysis.

- Clarity is required on the different frameworks, disclosures, and taxonomies so stakeholders can make informed decisions.

Well-defined metrics and open data allow for comparison

- There is value in agreeing upon and developing specific metrics to be able to compare and contrast between organisations and hold them to account.

- Having open and accessible climate data allows for all further analysis to be grounded in a single source of information.

Why did we run the event?

Currently, access to much of the world’s financial data for assessing and measuring the transition to net-zero is restricted in some way. It is essential to unlock the data flow by creating processes, policies, and guardrails that make sure data is comparable, machine-readable, and trusted. Opening up data and using Open Data reduces the friction in a wide range of use cases for climate-related financial data. A federated, web-based approach for accessing open data allows practitioners to connect rather than collect required datasets. This is aligned with our Icebreaker Principles (open to comment).

This event convened key data providers and users to discuss the ambitious future with open climate data at the heart of innovative solutions. In preparation for the event, Climate Arc developed an ecosystem map of the current market and how data flows between them. This was then used as a basis for two workshops during the event. The first workshop session challenged attendees to think through what is missing and what solutions are needed. The second workshop asked participants to think through what principles should be considered to deliver an operational open climate finance data ecosystem, and how to achieve widespread adoption.

Register your interest to be involved

in future events and conversations

Resources:

Please find the event briefing note, ecosystem map, slides and workshop materials below: