Addressing the climate crisis requires us to combine innovation across finance, policy, our physical and data infrastructures.

Physical vs data infrastructure

It is easy to see our physical infrastructure—including energy, water, transport, built environment, agriculture. Our financial systems are also clear—including investors, insurers, asset owners and managers and banks. Policy is shaped by known structures at city, national and international levels. Our scientific institutions have huge resources and knowledge to share. It is less clear what data infrastructure might be required to fully bring these areas together in a coherent manner: how can we create product and service innovation that properly quantifies and codifies risk, and makes it actionable by markets?

Designing for humans and machines

Separately, I’ve been in related sessions in which questions such as ‘what data do we need in order to address the SDGs?’ were asked. To me this is the wrong way round: we must start with specific user-needs, then look at the broader architecture and design principles for realistic, scalable interventions. A blend of bottom-up and top-down.

Equally, as Azeem has noted, innovation has to balance the precautionary principle and permissionless innovation (‘don’t ask permission’ culture):

“what should the goldilocks zone of regulation look like? How can we support fevered exploration while managing risks, especially systemic, run-away or existential ones?”.

Azeem Azhar

I can think of no better example right now of the need for ‘fevered exploration’ while managing risk than the climate crisis. We have an ‘Apollo Mission + Manhattan Project + Marshall Plan’-level (AMMP-level?) of innovation to go through in the coming decade: 2020 to 2030 will define the shape of the coming centuries, not just decades or years.

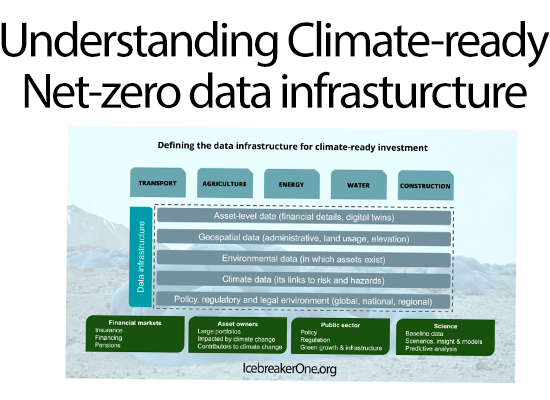

The data infrastructure for climate-ready investment

The market need that has been articulated to us over the last 18-months has been ‘bring us the data and we’ll innovate’. A natural question is ‘which data, how, and why?’. Through workshops and many, many conversations we have started the journey to understanding what is needed. This is version 1.0.

We are starting a new conversation: what data are needed to support innovation that spans finance, policy, and science in practical and actionable ways? How can we design for humans and machines in the process, to make data findable, usable and re-usable?

- Asset-level data (financial details, digital twins)

- Geospatial data (administrative, land usage, elevation)

- Environmental data (in which assets exist)

- Climate data (its links to risk and hazards)

- Policy, regulatory and legal environment (global, national, regional, local)

For whom?

- Financial markets: Insurance; Financing; Pensions

- Asset owners: Large portfolios; those impacted by climate change; contributors to climate change

- Public sector: Policy; Regulation; Green growth & infrastructure

- Science: Baseline data; Scenarios, insight & models; Predictive analysis

Want to get involved? Contact us.

References

Policy framing — Regulation & financial innovation to deliver a carbon-zero future

Open CEFID directory — Who’s who in Climate, Environment, Finance, Infrastructure, and Data

Discussion papers — Overview of key areas of standards development

More on Data Infrastructure

UK National infrastructure commission — https://www.nic.org.uk/wp-content/uploads/Data-As-Infrastructure.pdf

Open Data Institute — https://theodi.org/article/who-owns-our-data-infrastructure

Energy Systems Data Taskforce — https://es.catapult.org.uk/reports/energy-data-taskforce-report

Finance Canda – Data Driven value from Open Banking — https://thebusinesscouncil.ca/wp-content/uploads/2019/07/Data-Driven-Issues-Paper-July-2019.pdf